The UK’s Competition and Markets Authority has designated Google Search with Strategic Market Status, marking the first major regulatory action under the Digital Markets, Competition and Consumers Act 2024.

This designation triggers mandatory remedies including choice screens for search engine selection and publisher controls over AI training data usage. We at Emplibot are tracking how these UK moves on Google Search oversight will reshape digital marketing strategies and search engine optimization approaches across the region.

Contents

ToggleHow the CMA Built Its Case Against Google

The Competition and Markets Authority launched its investigation into Google’s search dominance on January 14, 2025, and collected evidence from more than 80 stakeholders including publishers, advertisers, and competing search engines. The investigation targeted general search services and search advertising specifically, where Google commands over 90% market share in the UK. The CMA analyzed detailed data on search volumes, advertising revenues, and competitive dynamics that exposed Google’s substantial control over how UK businesses reach customers online.

Strategic Market Status Requirements

The Digital Markets, Competition and Consumers Act 2024 establishes clear thresholds for Strategic Market Status designation. Companies must demonstrate substantial and entrenched market power that significantly affects UK trade and economic activity. Google meets these criteria through its control of search services, plus its ecosystem of trillions of historical searches and billions of indexed websites that competitors cannot replicate. The designation process required the CMA to prove Google’s strategic significance to digital activities and its position as a gateway for businesses to reach consumers.

October 2025 Decision Timeline

The CMA confirmed Google’s Strategic Market Status on October 10, 2025, after months of consultation and evidence collection. This timeline included a roadmap published in June 2025 that outlined potential interventions, stakeholder feedback periods, and discussions with Google representatives. The final decision triggers a consultation phase for specific remedies, with proposed interventions expected later in 2025. The CMA structured this timeline to balance thorough investigation with swift action, since delayed intervention allows market distortions to deepen.

These regulatory foundations now set the stage for specific remedies that will reshape how Google operates its search services in the UK market.

What Remedies Will Change Google Search

The CMA’s proposed remedies target three core areas that will fundamentally alter Google’s search operations in the UK. Choice screens will become mandatory for new devices and browser installations, requiring users to select from alternative search engines like Bing, DuckDuckGo, or Startpage before they access Google Search. This mirrors the EU’s approach but goes further with periodic re-selection prompts and equal visual treatment for all search options. Publishers will gain unprecedented control over their content usage in AI Overviews and AI Mode features, with the ability to opt out without losing visibility in standard search results.

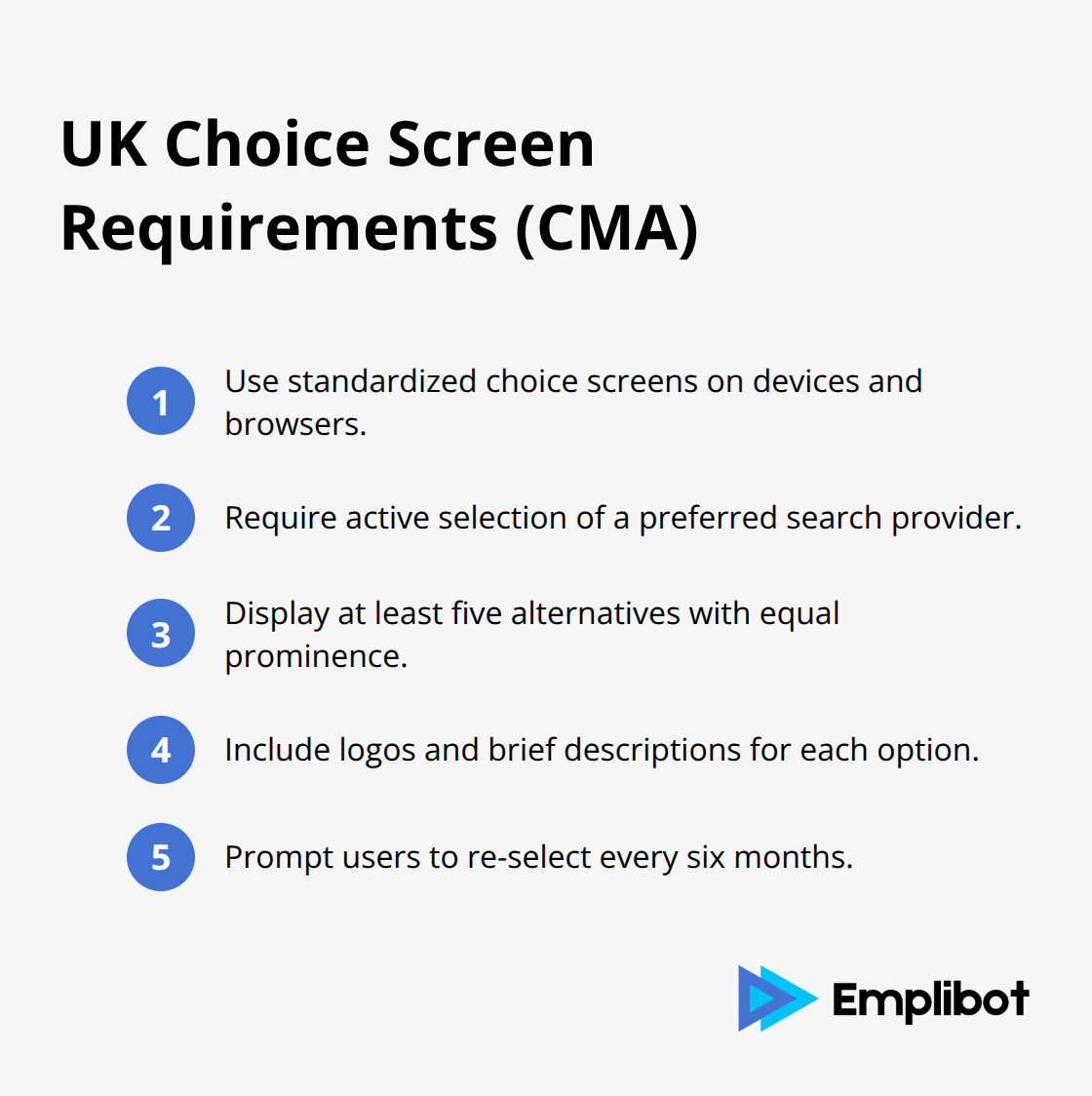

Choice Screen Implementation Requirements

The CMA mandates that device manufacturers and browser developers present search engine options through standardized choice screens. Users must actively select their preferred search provider rather than accept Google as the default option. The screens must display at least five alternative search engines with equal prominence, including their logos and brief descriptions.

Re-selection prompts will appear every six months to prevent choice fatigue and maintain active user engagement with alternatives.

Publisher Content Control Mechanisms

The CMA plans to implement technical standards that give publishers granular control over how Google uses their content in AI-generated responses. Publishers can block their articles from AI Overviews while they maintain normal search visibility, addressing the 47.5% clickthrough rate decline on desktop and 37.7% mobile drop that Authoritas reported when AI Overviews appear. These controls extend to future AI features and prevent Google from automatically incorporating publisher content into new generative AI products. The mechanism includes real-time opt-out capabilities and requires Google to respect publisher preferences within 24 hours of notification.

Data Access Requirements Transform Competition

Google must provide competitors and new entrants with access to search index data and ranking signals that currently create insurmountable barriers to entry. This includes sharing aggregated search query patterns, click-through rates by result position, and quality signals that inform ranking algorithms. The data access requirement specifically targets Google’s advantage from trillions of historical searches and allows alternative search engines to build competitive services. These measures aim to address Google’s dominant position in UK search services.

These regulatory changes will force businesses to adapt their digital marketing strategies as the UK search landscape becomes more competitive and fragmented.

How Should Marketers Adapt to UK Search Changes

The CMA’s regulatory actions demand immediate strategic shifts in digital marketing approaches across the UK. Traffic diversification becomes non-negotiable as Google’s market dominance faces systematic dismantling through choice screens and data access requirements. Publishers must prepare for a fragmented search landscape where Bing, DuckDuckGo, and AI-powered search engines capture market share from Google’s current 90% dominance.

Build Multi-Engine Content Strategies

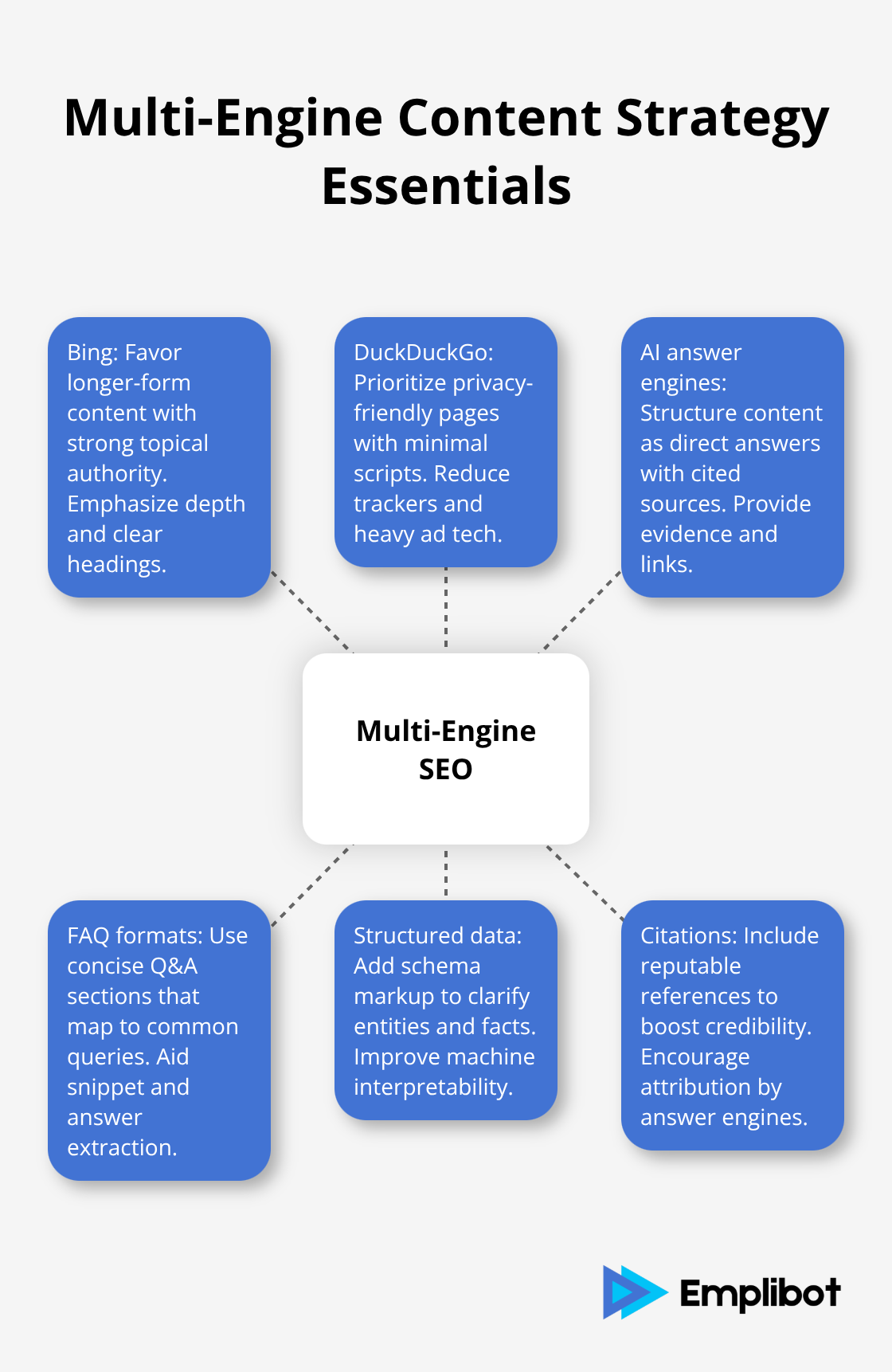

Alternative search platforms process queries differently than Google and require distinct optimization strategies. Bing favors longer-form content with clear topical authority, while DuckDuckGo prioritizes privacy-focused sites with minimal scripts. AI-powered search engines like Perplexity and ChatGPT Search reward content structured as direct answers with evidence. Publishers should create content formats that perform across multiple engines rather than optimize solely for Google’s algorithms.

This includes FAQ-style content, structured data markup, and citation-rich articles that answer engines can reference and quote.

Track Performance Across Search Platforms

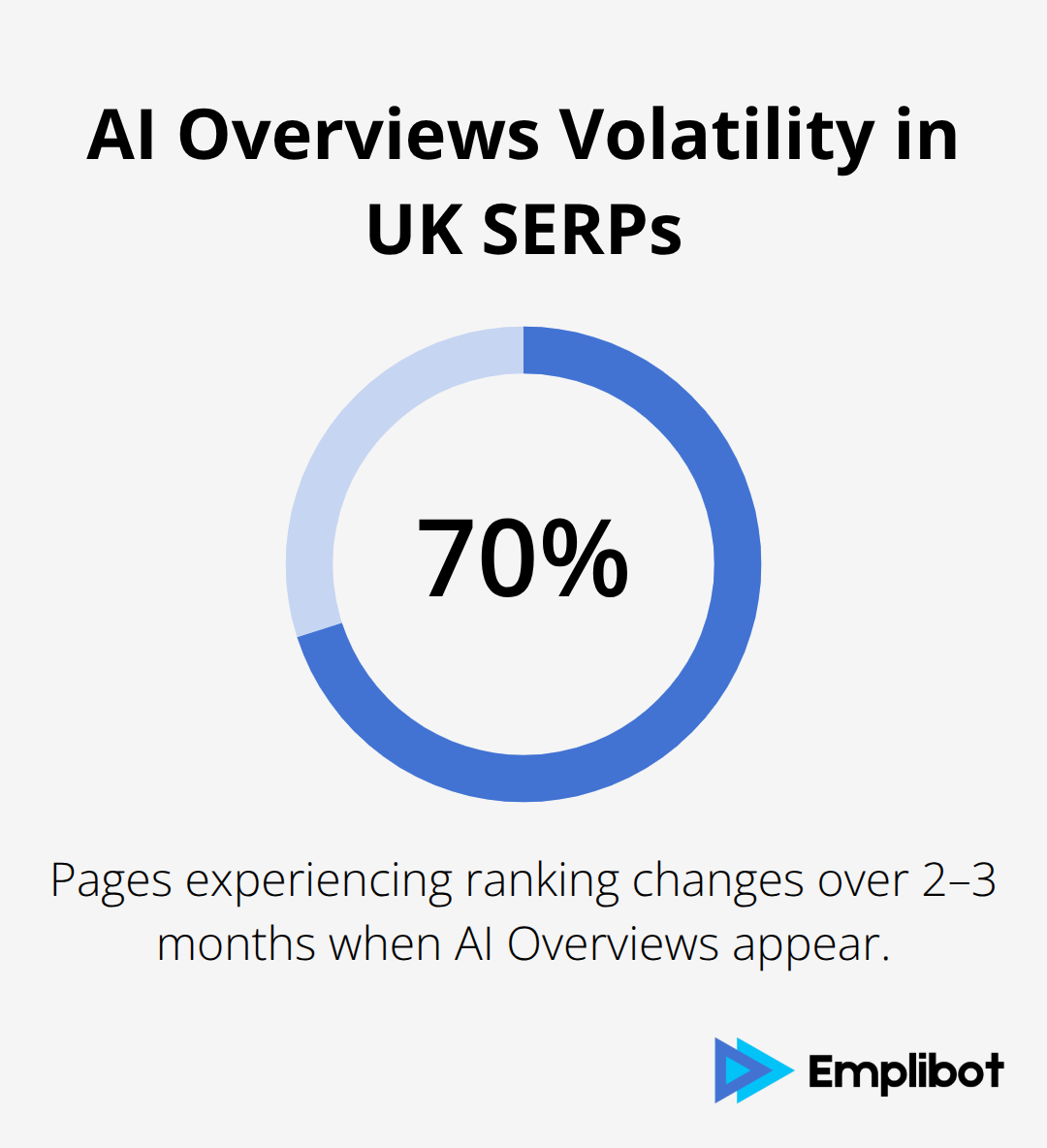

UK-specific SERP experiments will intensify as choice screens drive users toward alternative search engines. Publishers need separate analytics systems for each major search platform to identify traffic shifts and optimization opportunities. Monitor citation rates from AI answer engines, as these platforms drive traffic through content attribution rather than traditional click-through patterns. Research shows that AI Overviews create significant volatility in search results, with 70% of pages experiencing ranking changes over 2-3 months, making citation measurement essential for content impact assessment.

Set up automated alerts for UK search result variations, as regulatory pressure will trigger frequent algorithm adjustments and feature rollouts across all major search platforms.

Prepare Content Distribution Systems

Automated content distribution becomes vital as the UK search market fragments across multiple platforms. Publishers must adapt their content workflows to serve different search engines simultaneously while maintaining quality standards. Answer engines require structured formats with clear citations, while traditional search engines still value comprehensive topic coverage. Content automation tools can help manage this complexity by creating multiple content versions optimized for different search platforms without manual intervention. Understanding the zero-click search trend becomes crucial as users increasingly consume information directly from search results pages.

Final Thoughts

The UK moves on Google Search oversight mark a permanent shift in digital marketing. Google has criticized the CMA’s designation as “disappointing and disproportionate,” warning that regulatory interventions could stifle UK innovation and delay AI product launches. The CMA’s actions signal that competitive search markets will replace Google’s monopolistic control.

These regulatory changes will reshape how businesses reach customers online. Publishers face immediate decisions about AI content usage while they prepare for traffic diversification across multiple search platforms. The fragmentation of Google’s 90% market dominance creates opportunities for alternative search engines to capture significant user bases through mandatory choice screens (with periodic re-selection prompts that maintain active user engagement).

Success in this new landscape requires automated content distribution systems that serve multiple search platforms simultaneously. Publishers need robust analytics to track performance across Bing, DuckDuckGo, and AI search engines. Emplibot automates WordPress blog content creation and social media distribution, which helps businesses adapt to these market changes. The CMA’s Strategic Market Status designation establishes precedent for global tech regulation, with similar actions in the EU and US that suggest coordinated efforts to break up Big Tech monopolies.